The annual report from Business of Fashion and McKinsey & Co is back, highlighting the key issues that will test the resilience of fashion industry professionals in 2025. For the third year in a row, we at BCome have analyzed The State of Fashion 2025 report to bring you a summary of the 10 major challenges to watch in the months ahead.

Titled “Challenges at Every Turn”, the report highlights that the negative environment anticipated by many in the fashion industry a year ago is now becoming a reality. While growth opportunities still exist, economic uncertainty, geographic disparities, and shifts in consumer behavior and preferences mean that seizing them requires navigating a labyrinth of challenges at every step.

The old playbook is now obsolete; the industry will need a new formula

These are the challenges that, according to BoF and McKinsey, will shape the fashion industry in the coming months:

1. The power of collective sustainability

The fashion industry is under increasing pressure to reduce its environmental footprint, but significant challenges stand in the way of achieving sustainability goals. The wide scale of supply chains makes it difficult to implement sustainable initiatives across all levels, and decarbonizing operations and adopting sustainable materials come with higher costs, particularly for smaller brands.

To overcome these challenges, the report advocates for collaboration among brands, suppliers, innovation experts, and policymakers. Additionally, it emphasizes the importance of prioritizing solutions that deliver both environmental and economic benefits to drive large-scale adoption.

Sustainability represents the key challenge and opportunity the fashion industry will face in the coming years, and addressing it will require adaptability, innovation, and a willingness to adopt new business models and technologies.

Decarbonisation of fashion’s supply chain could cost $1 trillion, but it is likely more economically viable than executives think

2. The art of inventory management

Effective inventory management is becoming increasingly crucial in the fashion industry, driven by margin pressures and the need to minimize textile waste. BoF highlights several key factors, such as unpredictable demand, supply chain disruptions, and the growth of omnichannel retail. These issues are making efficient inventory management more challenging. As a result, it is recommended that brands adopt a comprehensive approach that covers forecasting, planning, purchasing, production and distribution.

The use of technology, such as data analysis tools, AI-based forecasting, and advanced supply chain management systems, is considered essential for optimizing inventory levels.

An end-to-end transformation is estimated to yield 10 to 15% cost savings in retail, whilst implementing individual solutions across functions typically yields only 5 to 10%

3. A greater focus on value

The global economic landscape, marked by inflation and uncertainty, has led to a shift in consumer behavior towards a greater focus on value. Sources indicate that consumers, increasingly price-conscious, are seeking ways to save money by cutting back on non-essential spending, such as fashion.

The second-hand market, low-cost brands, and those offering cheaper replicas of popular products are experiencing significant growth.

Brands must be able to clearly demonstrate their value proposition to compete in this environment, which may involve offering more competitive prices, highlighting the quality and durability of their products, or providing customer service that stands out.

Every consumer cares about value and making sure they’re putting money into something that reflects what they care about

Patrice Louvet, CEO of Ralph Lauren

4. The reconfiguration of trade

The report highlights a significant shift in global trade dynamics. The traditional reliance on China as the main sourcing hub is decreasing due to geopolitical tensions, rising costs, and the need for greater resilience in the supply chain. As a result, fashion brands are diversifying their production sources, exploring alternative locations in Asia, and embracing nearshoring.

Among the factors driving this change is the reduction in the percentage of garments and textiles imported from China to both the US and the EU. Additionally, the rise of new sourcing hubs such as India, Vietnam, and Bangladesh has allowed for lower prices, favorable trade agreements, and government incentives.

On the other hand, the growing interest in nearshoring, driven by the need for faster delivery and greater control over supply chains, has benefited countries closer to consumer markets, such as South America for the US and Turkey for Europe.

The share of apparel foreign direct investment into nearshoring manufacturing has increased by 20% for the US and 8% for Europe in the last five years

5. The new growth engines of Asia

Although China remains an important market, its economic slowdown and changes in the consumer landscape are prompting international fashion brands to explore other high-growth Asian markets.

India is emerging as an attractive market due to its strong economic growth, making it an ideal destination for mid-range fashion brands, with the fashion market growing at a rate significantly higher than the global average. On the other hand, the luxury market in Japan is thriving, driven by a rise in tourism and a favorable exchange rate, with prospects for continued expansion.

India is a unique country which has both sourcing as well as consumption capacity

Nandita Sinha, CEO of Myntra

6. Sourcing options expand

The wide range of options available in the market, along with the rise of digital platforms, has created a paradox of choice for consumers. The report suggests that too many options can overwhelm shoppers, resulting in lower conversion rates.

To address this challenge, artificial intelligence offers solutions that personalize product discovery and enhance the shopping experience, such as AI-powered recommendation engines, visual search tools, and personalized style advice. However, brands must balance innovation with ethics, taking into account issues such as data privacy, algorithmic biases, and the potential impact these innovations could have on job reduction.

82% of customers want AI to assist in reducing the time they spend researching what to buy

7. The human side of sales

In an increasingly e-commerce-dominated world, the in-store experience must offer something unique and compelling to attract customers. The study highlights that human interaction remains a key differentiator for physical retail, and well-trained sales associates can provide personalized service, offer style advice, and build connections with customers.

Quality service from store staff can lead to higher sales, increased average order value, and improved customer loyalty. However, retail still faces challenges related to high employee turnover rates and rising labor costs. To address these challenges, brands are encouraged to invest in enhancing their employees’ experience by prioritizing training, development opportunities, and competitive compensation packages to attract and retain talent.

75% of shoppers are likely to spend more after receiving high-quality service from store personnel, indicating upsell and cross-sell opportunities

8. The instability of marketplaces

Fashion marketplaces are facing new challenges. On one hand, there is increased direct competition from brands, as direct-to-consumer (DTC) channels have become more sophisticated, allowing brands to sell directly to their customers and bypass marketplaces.

Additionally, new players like Shein and Temu are challenging these businesses with low prices and aggressive growth strategies. To survive, marketplaces must evolve by differentiating their offerings, prioritizing profitable orders, exploring new business models such as B2B services, and leveraging technologies like generative artificial intelligence.

It is possible to create a luxurious experience online, but it’s not a copycat of what the store can do. What we can do is understand what the customer wants from us

Michael Kliger, CEO of Mytheresa

9. The competitiveness in sportswear

The sportswear market is experiencing intense competition, with emerging brands challenging the dominance of the giants. Brands like Hoka, On Running, and Lululemon are rapidly gaining market share thanks to product innovation, niche segmentation, effective marketing strategies, and a focus on direct-to-consumer channels.

Both established and emerging brands will need to innovate and adapt to capture this growth opportunity. On the other hand, it will also be important to diversify their offerings to attract a broader audience without losing cultural relevance, which includes carefully selecting the sports categories and athletes they partner with.

We’re trying to make sure that we are staying up to date, or ahead, in tech innovation that allows us to get closer to that consumer, allows us to spot trends earlier, [and] most importantly, to respond to those trends earlier in time to be meaningful

Joe Preston, President and CEO of New Balance

10. The aging of the market

The report highlights the growing economic power and influence of the so-called “silver generation”, consumers aged 50 and older, who represent a significant opportunity for fashion brands traditionally focused on younger audiences. This segment, driven by the aging global population, is generating a large portion of revenue.

In many markets, this generation holds a large percentage of wealth. Additionally, they have specific shopping needs and preferences: they prioritize quality and versatility over trends and may prefer different shopping channels.

We are clear on our mission today, which is about building a brand that really embodies multi-generational style, and continuing to evolve to meet the needs of all of those customers

Libby Wadle, CEO of J.Crew

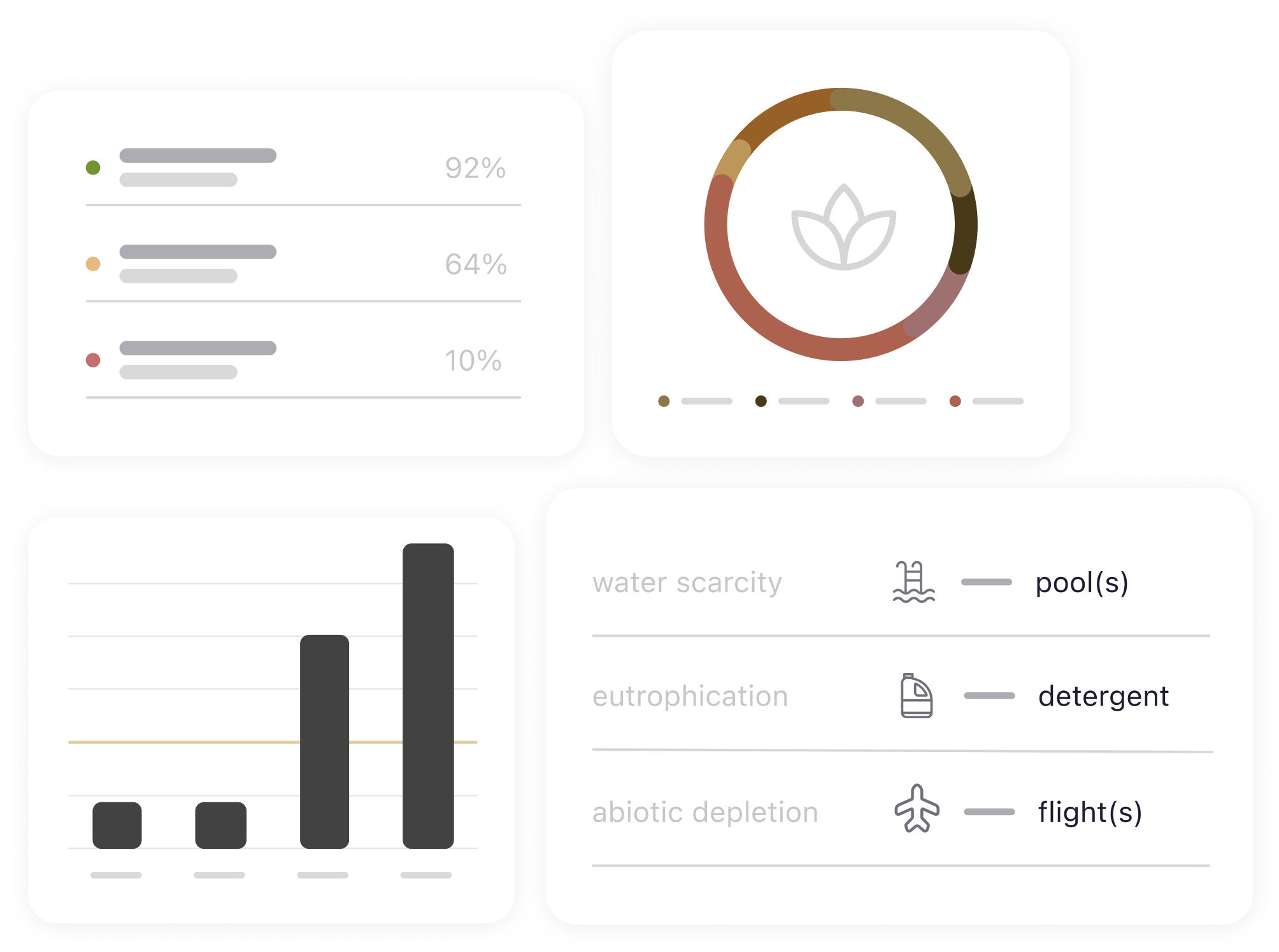

The State of Fashion 2025 report makes it clear that the fashion industry needs to rethink its playbook to face everything ahead in the coming months. Renewing the business model is key to adapting and moving forward. At BCome, we provide the tools you need to tackle these challenges, focusing on innovation, efficiency, and adaptability. We’re here to support you on your journey towards sustainability. Shall we talk?