77% of investors consider ESG reporting to be a central component in their decision-making process

PwC Global Investor Survey

How are you collecting and sharing valuable insights with your stakeholders in a reliable and easy way?

Requirements introduced by legislation

- New mandatory sustainability reporting standards, divided into the following categories:

- Environment

- Social

- Governance

- Information must be provided in a digital, machine-readable format.

- Third-party auditing to ensure the information reported is accurate.

Who must comply

- All large European companies that meet 2 of these 3 criteria:

- Revenues of more than 40 million euros

- Total assets over 20 million euros

- More than 250 employees

- All companies with securities listed on EU regulated markets, except micro-companies.

- Non-European companies with a net turnover in the European Union of more than €150M and with at least one subsidiary or branch in the EU.

Key law specifications

- Expanded scope of reporting beyond the current NFRD requirements.

- Replacement of the existing non-financial statement with a sustainability report.

- Introduction of a harmonized set of reporting requirements.

Penalties for non-compliance

- Each member state, during the transposition of the CSRD into national law, has the authority to establish its own penalties for non-compliance, providing flexibility in enforcement measures.

- The penalties introduced will likely be modeled on existing penalties under the NFRD, where sanctions range from fines of €25,000 or individual directors’ imprisonment to fines on the company, potentially reaching the higher of €10 million or 5% of the company’s global annual turnover.

Take action with BCome

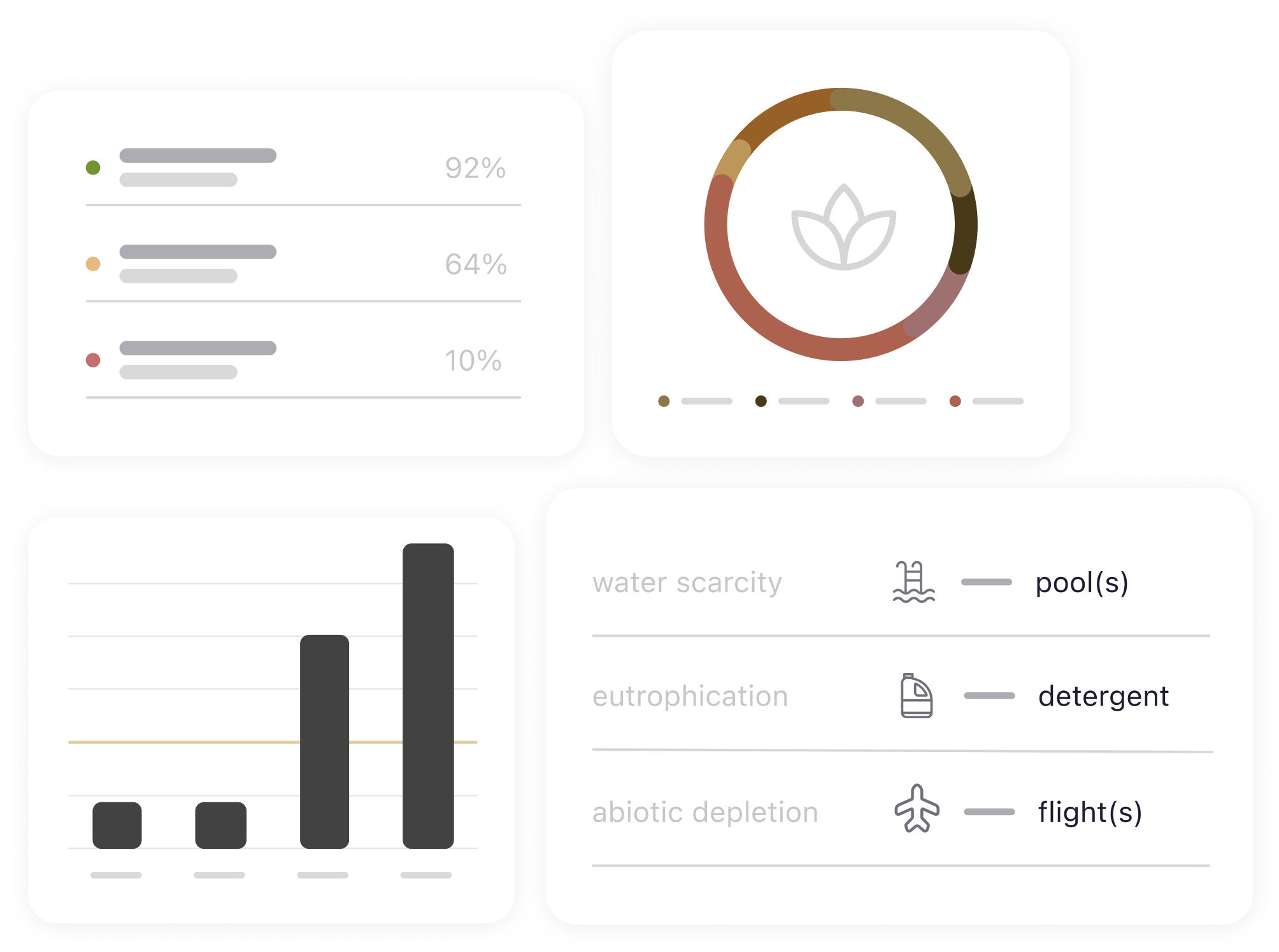

- Create customized reports with the most outstanding insights by project.

- Automatically share the required indicators using BCome’s digitization tools.

- Use BCome as a third party to verify the sustainability reporting standards.

Timeline for its entry into force and compliance

January 2026

Compliance for listed SMEs

Listed SMEs and other undertakings, with reports due in 2027.

January 2025

Compliance for large companies

Large companies (with more than 250 employees and/or €40 million in turnover and/or €20 million in total assets) not presently subject to the non-financial reporting directive, with reports due in 2026.

February 2024

Delay of sector-specific ESRS and for large non-EU companies

Council and Parliament agree to delay sustainability reporting for certain sectors and third-country companies by two years.

January 2024

Compliance for large public-interest companies

Large public-interest companies (with over 500 employees) already subject to the non-financial reporting directive, with reports due in 2025.

December 2023

Publication of the ESRS

Publication of the European Sustainability Reporting Standards (ESRS) in the Official Journal.

January 2023

Enforcement

The Corporate Sustainability Reporting Directive (CSRD) enters into force.

April 2021

Adoption of the proposal by the European Commission

The Commission adopts a proposal for a Corporate Sustainability Reporting Directive, which would amend the existing reporting requirements of the NFRD.