The highly anticipated annual report, The State of Fashion 2024, by The Business of Fashion and McKinsey, has just been released. This report outlines the imminent challenges that will shape the fashion industry in the upcoming year. It provides a comprehensive overview of the ten most significant topics identified by influential leaders in the textile sector.

Industry leaders are preparing for a strategically complex year ahead

Titled “Riding Out the Storm,” this eighth edition acknowledges the anticipation of further challenges that may affect the industry in the near future. The BoF-McKinsey survey highlighted “uncertainty” as the most frequently mentioned term by industry professionals. The year 2024 is expected to witness the consequences of fluctuating demand patterns that have marked recent years.

Industry leaders are preparing for a strategically complex year ahead. They are urged to meticulously plan for several potential scenarios, enhance their ability to manage pricing strategies, and gear up for rapid action when the context eventually calms.

The State of Fashion Report outlines the ten crucial issues that will dictate the textile industry’s priorities over the next twelve months:

Uncertain landscape

In 2024, the global economy is expected to remain uncertain due to ongoing financial and geopolitical issues. These factors are affecting how confident people feel about spending money, which is causing different challenges for the fashion markets in the United States, Europe and China. To tackle these challenges, suppliers, brands and retailers need to focus more on planning ahead and taking proactive steps to deal with the problems they’re facing.

The anticipated global GDP growth rate is projected to decrease to 2.9% in 2024. This slowdown suggests a potential moderation in consumer spending for the upcoming year. Notably, in the third quarter of 2023, the inclination to purchase apparel was positive at 7% in China, whereas it showed negative figures in the US and Europe. However, within emerging countries in Asia, there are potential growth opportunities, particularly in India. The country’s robust investment activity, domestic demand and developing infrastructure position it as a promising market for the fashion industry.

In this challenging environment, fashion businesses seeking funding should have solid performance fundamentals demonstrating sustainable profitability, clear brand equity and a path to value creation.

The Tumultuous Path to an Exit by Sara Hudson, Pamela Brown, Leila Le Merle and Simona Kulakauskaitė

Climate urgency

The surge in extreme weather events throughout 2023 has heightened the visibility of the climate crisis, leaving the fashion industry particularly susceptible within its value chain. With climate-related risks intensifying worldwide, it’s imperative for the fashion sector to swiftly integrate resilience measures into its supply chains and actively contribute to reducing emissions to mitigate these threats.

Fashion, accounting for 3% to 8% of total greenhouse gas emissions, holds a significant environmental responsibility. By 2030, the escalating frequency of extreme weather events could jeopardize approximately $65 billion in apparel exports and result in the loss of nearly one million jobs across four economies pivotal to the global fashion industry. Despite these critical implications, fashion executives foresee challenges like economic uncertainty, geopolitical tensions, and inflation competing for attention in 2024, potentially diverting focus away from addressing climate risks.

67% of cotton exports and 52% of apparel exports are highly affected by climate disasters.

Numbers from United Nations Office for Disaster Risk Reduction, World Trade Organisation

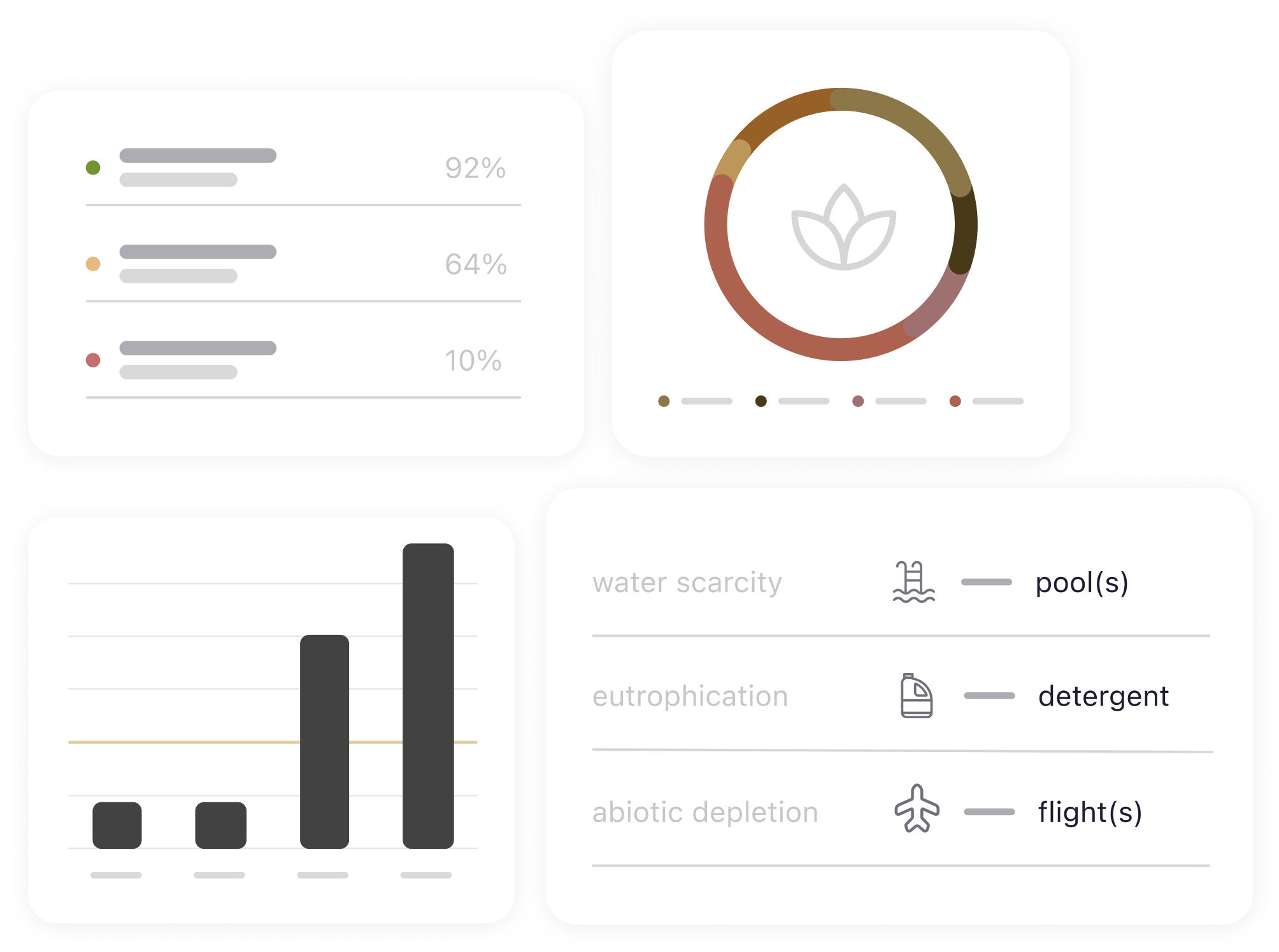

Sustainability rules

The fashion industry’s period of self-regulation on sustainability is nearing its end worldwide, signaling the imminent arrival of new regulations with far-reaching effects on consumers and industry players alike. Brands and manufacturers must undergo significant transformations in their business models to align with these forthcoming changes.

In late 2023, the European Union alone was deliberating on approximately 16 pieces of legislation concerning fashion. These rules encompass the entirety of the fashion value chain, impacting aspects from product design to marketing strategies and will exert influence on both global consumers and companies. Embracing regulatory compliance shouldn’t solely reside within the sustainability team of a brand but should instead be integrated across the entire leadership within a company, spanning multiple functional areas.

We talk about the internal lever that communicators can help play to help ensure that there’s accountability for change within the business. Also [they can] help play a role within the policy landscape, recognizing that a lot of these businesses are incredibly powerful and that there could be an opportunity from a very competitive standpoint to advocate for wider change that facilitates sustainability in a wider sense.

Rachel Arthur, Advocacy Lead for Sustainable Fashion at UN Environment Programme

Fast fashion’s power plays

The coming year is expected to witness an even more intense competition among fast-fashion brands. Emerging giants like Shein and Temu are reshaping their strategies concerning pricing, customer experience and swiftness. Both disruptors and established players will likely need to swiftly adapt to changing consumer preferences while navigating potential regulatory changes.

The latest cohort of fast-fashion companies, marked as the third generation, has significantly captured consumers’ interest. Notably, 40% of US consumers and 26% of UK consumers have made purchases from Shein or Temu within the last year. Much of this generation’s success hinges on innovative operating models that prioritize speed and affordability in fashion production. These models incorporate agile supply chains directly connecting manufacturers to consumers and employ data-driven approaches in designing products. However, in 2024, these fast-fashion leaders might encounter challenges due to evolving expectations from both regulators and consumers, spanning concerns from sustainability to fair trade practices.

We don’t think that algorithms alone provide the best recommendations, so we try to mix our curation with the data to come up with the best recommendation for our customers.

Mun-il Han, Chief Executive at Musinsa

Pressure on suppliers

Changes in what consumers want have led to what’s called the “bullwhip effect” in the fashion supply chain. This means that when brands reduce the number of orders they make, the impact on suppliers further down the chain becomes much larger, creating pressure on them. To keep up with the expected increase in demand, brands and retailers should focus on being more open about how their products are made and creating stronger partnerships with others in the industry.

The unpredictability in demand has hit suppliers at the beginning of the supply chain the hardest. Factories that were working at full capacity in 2021 have seen a significant drop, operating only at 30% to 40% of their potential in 2023. The majority of purchasing managers, about 73%, believe that handling this unpredictability will be one of the biggest challenges in their relationships with suppliers in the next five years. Experts in manufacturing estimate that it might not be until the third quarter of 2024 that textile factories start to see improvements in their capacity.

The solution is based on better data and integrated systems, but it’s also based on something as simple as trust, and making sure that you do what you say you’re going to, if you do that over and over … they’re with you on that journey. That builds the possibility for them to continue to grow their business. It’s like it’s the absolutely best thing that can happen to us, that our suppliers continue to thrive, and invest in innovation, sustainable solutions, circularity, technology and so on. The day they don’t, then I’m troubled.

David Savman, Chief Supply Chain Officer at PVH Corp

Gen AI’s potential

Following generative AI’s significant advancements in 2023, its application is expanding in creative sectors, including fashion. To fully harness the potential of this revolutionary technology in 2024, fashion entities need to move beyond simply automating tasks and instead, explore how it can enhance human work.

McKinsey’s analysis suggests that up to a quarter of generative AI’s potential value in the fashion industry could stem from its application in design and product development. Despite this potential, a substantial gap exists: while 73% of fashion leaders consider generative AI a priority for their businesses in 2024, only 28% have actually used it in the creative processes related to design and product development.

Across the fashion and luxury value chain, companies will likely see the largest profit gains from gen AI in product design and assortment, followed by content-focused marketing, and sales and customer experience, according to McKinsey forecasts.

The return of brand marketing

Looking ahead, brand marketing is poised to regain prominence within the fashion industry, eclipsing the previous dominance of performance marketing. Fashion marketers are recognizing the crucial role of consumers’ emotional ties to brands, prompting a shift in strategies towards emphasizing long-term brand-building approaches.

Adapting to the changing landscape, fashion marketers are grappling with the escalating costs associated with performance marketing and the constraints posed by data privacy regulations, limiting targeted customer outreach. According to the BoF-McKinsey survey, 71% of fashion professionals are planning increased investments in brand marketing compared to previous years, whereas 46% are intending to allocate higher budgets for performance marketing. To strengthen emotional connections with consumers, brands are likely to pivot towards marketing efforts aimed at crafting compelling brand narratives.

There’re so many communication tools that have appeared and you need to always be adapting to […] Compared to the past, we have to produce much more content. Not so long ago, you were doing one ad campaign, maybe a little film every season. Marketing the fashion side was essentially just pictures.

Olivier Bialobos, Deputy Managing Director, Communication and Image at Dior

Travel boost

Travelers are getting ready for the busiest year of travel since before the pandemic hit. However, their values have shifted and they now have different expectations when they travel, even though shopping remains a top priority. Brands and retailers need to rethink how they sell their products and the types of products they offer to meet the needs of travelers, wherever they might be.

Insights indicate that global travel is estimated to surpass pre-pandemic levels in 2024, reaching as high as 110% of the numbers seen in 2019. According to the BoF-McKinsey, 80% of surveyed consumers in the US, UK and China plan to shop for fashion while traveling in 2024. Moreover, 28% of them intend to spend more compared to the previous year.

Travel’s rebound creates an opportunity to view their global growth maps with a new lens. As their customers seek out more unique, off-the-beaten-path experiences, fashion players should consider proactively identify emerging hotspots, while innovating marketing initiatives and piloting activations that resonate with 2024’s travel zeitgeist.

The new face of influence

Brand marketers need to update how they work with influencers. There’s a new set of creative people getting noticed by brands and gaining trust from important audiences. Partnering with these personalities in 2024 will need a different kind of teamwork. It’ll focus more on videos and brands might have to be okay with giving up some control over the creative process.

Recent studies show that many consumers are feeling overwhelmed by the amount of sponsored posts they see on social media. Additionally, a majority of them are not as interested in fashion influencers as they were in the past. People now want creators who are genuine, entertaining and relatable. This demand has led to a rise in a fresh breed of creators who embrace a more casual and authentic style, incorporating humor, uniqueness, and personal openness.

Slowly, through storytelling, I built a really strong connection with my audience around a very few, very high-end products, which are historically very difficult to market, and it gave the brands no choice but to work with me.

Gstaad Guy

Outdoors reinvented

Consumers’ increased focus on healthier living after the pandemic and the rising popularity of “gorpcore” have given a significant boost to technical outdoor clothing. This trend is expected to gain even more momentum in 2024. More outdoor brands might introduce lifestyle collections, while lifestyle-focused brands will likely incorporate technical features into their lines. This merging of functionality and fashion is further blurring the boundaries between traditional outdoor wear and everyday clothing.

The recent shift of outdoor clothing and shoes into daily wardrobes means brands are working hard to blend style and practicality even more closely. Competition in 2024 is anticipated to intensify across different price ranges and types of clothing. Some outdoor brands may pivot towards higher-end apparel, while others might focus on innovating in the footwear sector.

In the case of On, we’ve been working very hard over the last 13 years — it’s still a young brand — to build at the intersection of innovation, but also design and sustainability, because we feel if you get that formula right … I think you [can] be relevant for the consumer in this market.

David Allemann, Co-Founder of On

The key takeaway from The State of Fashion 2024 Report is the need to reconsider the fashion industry’s approaches to flourish in an unpredictable environment. It’s crucial to regenerate the business model to better navigate uncertainty. At BCome, we offer the necessary tools to confront these challenges by emphasizing innovation, efficiency and adaptability. We’re here to assist you in your pursuit of sustainability. Shall we talk?